The banking system is very complex and often times the amount of control it has over us, what type of control they have or how the system works is not understood blind siting most people. Henry Ford, founder of the Ford Motor Company, a significant figure in history and one of the richest men to have ever lived, said, “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

The 4 reasons Henry Ford said this.

The world of finance and banking, with its vast web of banks, investors, and governmental bodies, is a complex system that plays a crucial role in modern economies. It provides opportunities for savings, investment, and credit that drive growth, yet its workings are not commonly understood. To shed light on its mechanisms, we need to delve into some of the foundational aspects of the banking system.

1. Fractional Reserve Banking

At the heart of the banking model lies the concept of fractional reserve banking. Instead of holding onto every dollar deposited, banks keep a fraction and loan out the rest. For example, with a 10% reserve requirement, a $100 deposit might result in $90 being loaned out. This process essentially creates new money as that $90 is then deposited and re-loaned, creating a multiplying effect as there are now $190 active in the economy where there were previously only $100 because $100 Is owed to you by the bank and $90 is artificially owed to the bank. The advantage? It increases the money supply and encourages lending and investment. The risk? If too many depositors (like yourself) simultaneously demand their money, the bank may not have enough to cover all requests, potentially causing bank runs.

2. The Cycle of Interest and Debt

When banks lend out money such as the previously mentioned $90, they do so with interest therefore $95 might be owed back to the bank meaning the bank has now created $5 which is not officially in the economy which the bank can lend again and make more money on which did not previously exist. This model ensures their profitability. However, it also introduces a systemic problem. The money lent out, with interest, surpasses the original money supply. Therefore, there’s always more owed back to banks than what’s available in the economy as there isn’t enough money to pay back the whole amount, creating a continuous cycle of debt. This dynamic has led some to argue that it perpetually entraps individuals, businesses, and even whole nations into continuous debt giving banks significant influence and control over them as they are dependent on the banks and debt.

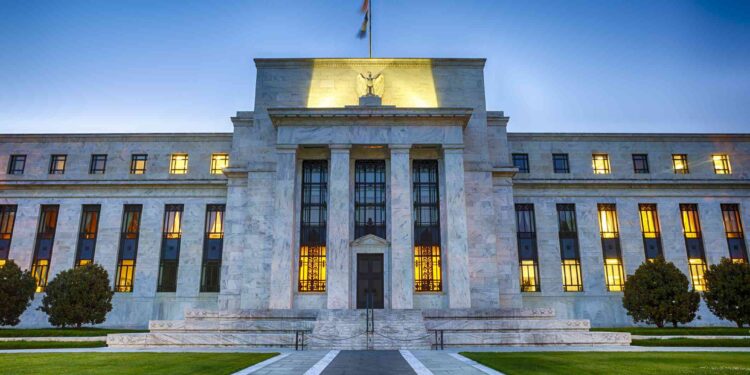

3. Control Over the Money Supply

Central banks have the power to influence entire economies. What is not commonly known is that central banks such as the Federal Reserve System is composed of 12 regional Federal Reserve Banks, which are set up like private corporations with shares owned by member commercial banks consisting of banks you would bank with on the high street or investment banks such as those on Wall Street. The Banks’ influence can be exerted through their own lending or by influencing the central banks, controlling the money supply (how much lending goes out towards starting businesses, what type of business, towards buying homes, development), determining interest rates, and overseeing monetary policies. They can either suppress or boost economic activities and therefore economic growth. Critics often point out the profound influence these non-elected entities have, which can potentially lead to policies that benefit them and their interests including disproportionately allocating wealth to businesses and markets that are preferred by them such as housing (affecting house prices), manufacturing, finance, entertainment (affecting jobs and growth of specific industries), retail (shopping), etc.. This can lead to an uneven distribution of wealth.

4. Banking Systems Are Intentionally Kept Complex

The very mention of “banking” or “monetary policy” can make the average person’s eyes glaze over. The complex language used in banking, the countless processes, and the high-level decision-making often feel removed from day-to-day life. Yet, these elements govern our economies and, by extension, our lives. Some believe that this complexity is purposefully maintained to keep the general population in the dark about how decisions are made and who benefits most from them.

Henry Ford’s view

Henry Ford comment regarding people starting a revolution, if they understood the banking system, relates to the facts above. In reality, people’s money is not safe as it is not fully guaranteed in the bank by the bank or the government, were something to happen to the bank or economy. You can be more empowered and gain control over your money by understanding how banks and governments influence your money.

There are numerous books that discuss the role, influence, mechanisms, and criticisms of central banks, especially in the context of controlling the money supply and setting interest rates. Here are some notable ones:

1.”The Creature from Jekyll Island: A Second Look at the Federal Reserve” by G. Edward Griffin

This is a controversial, yet popular book that delves into the formation and operations of the Federal Reserve. Griffin takes a critical stance, discussing the power and influence of central banks and their implications for democracy and economic health.

2.”The End of Alchemy: Money, Banking, and the Future of the Global Economy” by Mervyn King

Written by the former governor of the Bank of England, this book examines the global financial crisis of 2008 and the inherent vulnerabilities within the banking system. It provides insights into the role of central banks and the challenges of modern finance.

These books provide varying perspectives, from critical analyses to insider accounts, on the role and influence of central banks in the global economic system. Reading a combination of these will offer a comprehensive understanding of the topic and allow you to be in control of your money.

You can also get a book for free and listen to it on audible when you dign up by clicking below: